I am going to dumb this down a bit. Imagine you are at an amusement park and see one of the physics defying roller coasters. You sit in a line of sweaty little kids who have no sense of volume and are probably dripping their ice cream all over the place. You wait an hour to get to the front of the line and you see the relieved faces of families eagerly waiting to get the fuck off that ride. You know it sucks but you have committed way too much time to back out. This is where investors are in the market. No one truly knows what they are getting themselves into or if they will come out on the other side. What they do know is that they are in for a wild ride.

Earlier in 2020, the S&P 500 was trading comfortably above 3,300 and for now bottomed out in late March at 2,200. About a -33% drop in just over a month. Was that the bottom? To be honest no one really knows. Bill Ackman, founder of Pershing Square Capital Management and star of Netflix’s Betting on Zero, has flip flopped on this more than Caitlyn Jenner did with her gender. A flurry of banks reported Q1 earnings over the past day and are seeing declines of profits in the range of -45% to -89%. What a shame for the investment banks who amplified the financial crisis in 2008 to feel some hurt, you hate to see it. The energy sector currently resembles the ugly girl in high school who also had an equally bad personality. That girl is always a lose/lose situation. There is no demand and holds very little value. I am talking about oil prices, of course. Since we all are hunkered down and wearing the same pair of pants for a week straight, Consumer discretionary looks dryer than Kourtney Kardashian’s personality. Lastly, I cannot imagine there are any businesses looking for technology. As a country, I feel we treated Skype like a cheap hooker. Yeah, it gets the job done, but we want better. Now Microsoft is coming for Zoom’s ass.

What has been far more interesting is the relative strength the markets have shown over the past week. As the data gets worse and worse, the markets continue to recover. Now that the country is flush with Trump bucks, people will certainly go back to buying cars and houses. Amazon, Netflix, and Domino’s Pizza have been clear winners thus far in the pandemic. All you poors collecting government checks are keeping all three of these companies pumping. Amazon has taught us a real important lesson:

Amazon makes money in virtually every industry and is finding out they are recession proof. I can’t imagine much has changed at Domino’s. Still the same crack heads whipping up your $6 pizza that eventually costs $15. Coronavirus is nothing compared to the HEP-C that you will likely get from your medium pie. Netflix can thank that ole’ crazy bitch Carol Baskin.

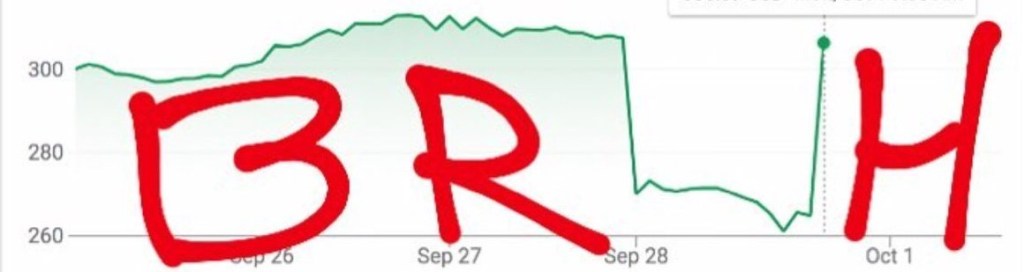

Standardly Poor Capital recommends reaching out to your closest FOREX trader friend for advice in this time of uncertainty. For now, I am going to heat up a frozen pizza in my underwear and watch my long positions make me rich. They should resemble something to the effect of this chart:

Stay Poor People